Laws and Regulations

Agritourism

Agritourism in California: Enhancing Your Farm's Potential

Agricultural tourism, known as Agritourism, offers a unique opportunity for farmers in California to diversify their income while providing enjoyable and educational experiences for visitors. Whether it's a farm stand, U-pick operation, farm stay, or a range of other activities, agritourism can be a valuable addition to your farming business.

At the UC Small Farm Program, we collaborate with county-based UC Cooperative Extension farm advisors to support agritourism operators. Our statewide directory and calendar of agritourism operations serve as valuable resources for both farmers and visitors. For more information, visit the UC SAREP Page on Agritourism.

However, before embarking on an agritourism venture, it's crucial to be aware of the regulatory considerations specific to California. Here are a few key points to keep in mind:

-

Zoning: Ensure compliance with local regulations by consulting your county zoning department to confirm that your agritourism activities align with agricultural land use.

-

Liability: Opening your farm to the public carries increased liability risks. Protect yourself by consulting with an attorney and your insurance provider to secure adequate coverage. Consider drafting a liability waiver for visitors.

-

Labor Laws: If you plan to hire employees for your agritourism operation, it's essential to be familiar with relevant labor laws. Consult with an attorney or your state labor department to ensure compliance and avoid any legal issues.

By understanding these considerations and addressing them appropriately, you can make the most of your agritourism venture while safeguarding your farm and visitors.

Discover the potential of agritourism in Yolo, Solano, and Sacramento counties, and unlock new revenue streams for your farm.

Regulatory Resources for Agritourism in Yolo, Solano, and Sacramento Counties

As a farmer venturing into agritourism, it's essential to understand the regulatory side of this exciting endeavor. To assist you, we've compiled a list of valuable resources specific to Yolo, Solano, and Sacramento counties. These resources will provide you with the information you need to navigate the regulatory landscape and ensure compliance.

-

UC Small Farm Program Agritourism Resources: The UC Small Farm Program offers a wealth of resources dedicated to the legal and regulatory aspects of agritourism operations. From informative webinars to publications, these resources provide guidance on key considerations for your agritourism venture.

-

County Zoning Departments: To ensure compliance with local regulations, it's crucial to contact your local county zoning department. They can provide you with specific information regarding zoning requirements and restrictions for agritourism activities in your county.

- Yolo County: 625 Court Street Woodland, CA 95695 - (530)666-8150

- Solano County: 675 Texas St.

Fairfield, CA 94533 - 707-784-1310 - Sacramento County: 4137 Branch Center Rd, Sacramento, CA 95827 - (916) 875-6603

-

State Labor Departments: If you plan to hire employees for your agritourism operation, it's important to consult with your state labor department. They will guide you on labor laws and ensure that you are in compliance with all relevant regulations.

By utilizing these regulatory resources and seeking guidance from the appropriate authorities, farmers in Yolo, Solano, and Sacramento counties can confidently navigate the regulatory landscape and operate their agritourism businesses successfully.

Business

|

Navigating Required Permits for California Farmers As a farmer or crop producer in California, understanding the necessary permits for your business is crucial. To streamline the process, we recommend utilizing the CalGOLD business web portal, a valuable resource managed by the California Governor's Office of Business and Economic Development. Here's how you can use CalGOLD to identify the permits you may need:

By utilizing the CalGOLD business web portal, you can easily identify the permits necessary for your crop production or farm business. Stay informed and compliant with the help of this valuable resource. |

| BUSINESS LICENSE |

|

Every business that operates in the state of California is required to obtain a business license from the city that you operate out of, regardless of how small you are. Search the CalGOLD website for business license information by selecting your city and business type. Read the application carefully because in some counties, agricultural operations are exempted. |

| Fictitious Business Name (DBA) |

|

In the state of California, it is mandatory to register a Fictitious Business Name (DBA) if certain conditions apply to your business. These conditions include:

To meet this requirement, you can access the necessary DBA registration forms through the respective county websites. Here are the specific forms for Yolo County, Sacramento County, and Solano County: DBA Forms: |

| LIABILITY INSURANCE |

|

Understanding Liability Insurance for California Farmers While there is no state law in California that mandates farmers or agricultural businesses to have liability insurance, it is crucial to recognize that many produce buyers require this type of coverage. Therefore, farmers are strongly encouraged to consult with their buyers to determine if liability insurance is necessary and the specific coverage amount required. In general, it is advisable for farmers to obtain a minimum of $2 million in liability coverage, which applies to both their operations and products. This coverage helps safeguard farmers from potential financial losses resulting from accidents or incidents. Farmers in Yolo, Solano, and Sacramento counties, as well as other regions in California, can reach out to local insurance companies specializing in farms or agribusiness. These experts can provide quotes and guide farmers in selecting the most suitable liability insurance coverage for their unique needs. By proactively securing adequate liability insurance, farmers can protect themselves and their businesses from unforeseen circumstances, meet the requirements of produce buyers, and ensure financial stability within their agricultural operations. |

| Sales and Use Permit (Seller's Permit) |

|

Seller's Permit Requirement in California If you plan to sell specific types of food and non-food items in California, such as flowers, salves, and soaps, you are required to obtain a Seller's Permit. The good news is that there is no fee involved in signing up for this permit. To determine if your food products are exempt from this requirement, you can refer to page 4 of the California Department of Tax and Fee Administration (CDTFA) Exemptions and Exclusions document. Obtaining a Seller's Permit is a straightforward process. You can visit the California Tax Service Center website for the necessary forms and instructions to complete your application. Remember, the Seller's Permit is essential for compliance when selling specific items, and it ensures that you can conduct your business operations smoothly within the state of California To obtain a Seller's Permit go to the California Tax Service Center website. |

| TAXES |

|

Tax Considerations for Small-Scale Growers in California Managing taxes can be complex for agricultural operations, and it is highly recommended to seek the assistance of a Certified Public Accountant (CPA) with expertise in farm taxes, especially during the initial year of operation. Income Taxes to the IRS

Property Taxes to the County

Understanding and complying with tax obligations is crucial for small-scale growers in California. By seeking professional guidance and staying informed about IRS and county requirements, you can ensure accurate tax filing and avoid potential penalties. |

Cottage Food Operation (CFO)

The California Homemade Food Act

-

California Homemade Food Act:

- Enacted on January 1, 2013. Establishes regulations for Cottage Food operations (CFOs) in California. Allows individuals to produce and sell limited quantities of non-potentially hazardous foods from their home kitchens.

-

Value-added Products for Farmers:

- Farmers can use their home kitchen for making value-added products.

- Gross annual sales limit for these items is up to $50,000.

-

Examples of Approved Products:

- Breads

- Candy

- Condiments

- Dry goods (tea, herbs, dried fruit, dried vegetables)

- Preserves

-

Registering as a CFO:

- Contact the Environmental Health Department of your county.

- Obtain a food handler's permit.

- Fulfill other requirements specific to your county's Cottage Food Program.

-

Types of Permits:

- Class A permits:

- Allow for direct sales from CFO to consumers.

- Class B permits:

- Allow for sales from CFO to retail food facilities (e.g., markets, bakeries) and/or directly to consumers.

- Class A permits:

-

Labeling and Packaging:

- CFOs have specific labeling and packaging requirements.

- Include ingredient lists, allergen labeling, net weight, and contact information on product labels.

-

Additional Resources:

Remember to verify the details and requirements with the California Department of Public Health (CDPH) and your local county agencies responsible for regulating cottage food operations, as regulations may vary.

Direct Marketing

|

FARMERS' MARKET |

|

|

Essential Certifications for Selling at Farmer's Markets As a small-scale grower in California, there are two important certifications you need to obtain in order to sell your produce at farmer's markets: the Certified Producer's Certificate and the Produce Scale Certification. 1) Certified Producer's Certificate California requires a Certified Producer's Certificate for selling at farmer's markets. To obtain this certificate, follow these steps:

2) Produce Scale Certification To ensure accurate weighing of your produce at direct-to-consumer sales points, such as farmer's markets, it is necessary to have your scales certified. Here are the specific requirements for each county: Yolo County:

Sacramento County:

Solano County:

Ensure compliance with the certification and registration processes to maintain transparency and meet legal requirements when selling at farmer's markets. Please note that it's important to stay updated with the specific regulations and requirements of the California Department of Food and Agriculture, the Agricultural Commissioner's Office in your county, and the Weights and Measures departments to ensure compliance. |

|

| FARM STANDS | |

|

We recommend visiting the UC Small Farms Program Farm Stand Regulations page for detailed information regarding farm stand regulations. If you're planning to set up a farm stand in California, it's essential to understand the regulations specific to your county. Here are some key questions to consider before contacting the county authorities: Location and Permits:

Zoning and Location:

Hours of Operation:

Product Restrictions and Labeling:

Health and Safety Regulations:

Signage and Advertising:

Parking and Traffic:

Value-Added Products and Prepared Foods:

Additional Costs and Fees:

Resources and Workshops:

Other Permitted Sales:

Scale and Certifications:

Other Regulations and Permits:

Information by CountySacramento County

Solano County

Yolo County

Other Counties/General Information:

|

|

|

COMMUNITY SUPPORTED AGRICULTURE (CSA) |

|

|

Keep in mind:

CSA BoxesCSA Box Labeling:

Traceability Records:

Informing Consumers:

Labeling for Eggs and Processed Foods:

Multi-Farm CSA Handling License:

To register your CSA, visit the CDFA Certified Farmers' Markets page. Scroll down to the end of the page for the CSA Producer Registration and Remittance Form. The annual registration fee is $75. |

Employees

Please see the CalGOLD website and not the permits and requirements for "businesses with employees". A few examples include:

- Employers in the United States generally need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This is used for tax purposes and to identify the business entity.

- The IRS provides Publication 51, which is the Agricultural Employer's Tax Guide. This guide provides information on filing quarterly payroll taxes and covers the employer's percentage of tax withholdings specific to agricultural employers.

- The California Labor Commissioner's Office is responsible for enforcing labor laws in the state. They oversee wage and hour laws, including minimum wage, overtime, meal and rest breaks, and other employment-related regulations.

- California has Wage Orders that provide detailed information on wage and hour laws specific to different industries, including agricultural businesses. These orders outline requirements regarding minimum wage, working hours, and other employment conditions.

- The California Department of Industrial Relations oversees workers' compensation, which is a system that provides benefits to employees who are injured or become ill as a result of their work. Employers in California generally need to carry workers' compensation insurance or be self-insured.

- The Occupational Safety and Health Administration (OSHA) sets guidelines and regulations for workplace safety. Employers, including agricultural businesses, are required to have an Injury and Illness Prevention Plan (IIPP) in place to ensure a safe working environment.

- The California Employment Development Department (EDD) manages various employment-related programs, including unemployment insurance and payroll taxes.When you hire employees, you'll need to register as an employer with the Employment Development Department (EDD). This helps you stay compliant with payroll taxes and other employment-related programs.

- The Western Center for Agricultural Health and Safety provides resources and information related to the health and safety of farm employees. They offer online and in-person resources to support agricultural employers in maintaining a safe working environment.

- Employers in California are required to display certain posters in the workplace to inform employees about their rights and responsibilities. This may include posters related to OSHA, minimum wage, and anti-discrimination laws.

Food Safety

| FOOD SAFETY MODERNIZATION ACT (FSMA) | |

|

The following information is the National Sustainable Agriculture Coalition (NSAC): Food Safety Modernization Act (FSMA) Key components of FSMA:

The [produce] rule does not apply to:

Things to Consider:

Inspections and documentation are required. Please see the CDFA produce Safety page for more information Is your farm required to be compliant under FSMA? In order to determine what parts of FSMA you are required to comply to, start by working through one of the FSMA Flowcharts: FSMA Flowchart (source: National Sustainable Agriculture Coalition) FSMA Flowchart (source: FDA via CCOF) FSMA Fact Sheet (source: FDA via CCOF) FSMA Exemptions To check for further exemptions check the FDA FSMA Exemptions page (Source: FDA FSMA Final Rule of Produce Safety and NSAC's Qualified Exemptions and Modified Requirements (Produce Rule). |

|

| FOOD AGRICULTURAL PRACTICES (GAPs) | |

|

The following information is from the National Sustainable Agriculture Coalition: Good Agricultural Practices (GAPs). "To provide a standard food safety audit system for producers, packers, and distributors, USDA and various inspection and standardization agencies developed the Good Agricultural Practices (GAP) and Food Handling Practices (GHP) Audit Verification Program. The GAP and GHP program is a voluntary, user-fee funded independent audit program offered to the produce industry to verify that fresh fruits and vegetables are produced, packed, handled, and stored according to food safety practices that minimize the risks of microbial food safety hazards. The audits are based on recommendations from the U.S. Food and Drug Administration (FDA) and open up new markets for producer, packers, and distributors seeking to sell to schools, grocers, wholesalers, and others that require food safety certification. USDA and FDA are currently working on aligning the USDA GAPs program with the new FSMA requirements, so that GAP certification can provide farmers with the confidence that they are also in compliance with FSMA. As the go-to certification program for many small and mid-sized produce farmers, NSAC, is working to ensure that the USDA GAPs program, including the new Group GAP certification option, remains a relevant and viable option for family farmers".

|

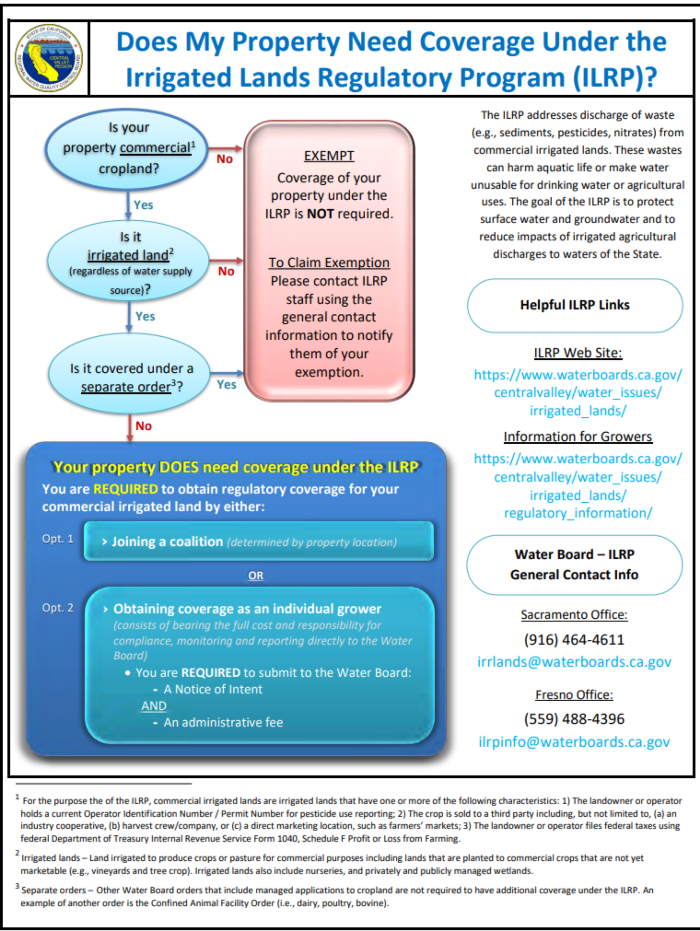

Irrigated Lands Regulatory Program: Nitrogen Use Reporting

| IRRIGATED LANDS REGULATORY PROGRAM: NITROGEN USE REPORTING |

|

All farm operations who irrigate are required to participate in the state mandated Irrigated Lands Regulatory Program. This program is regulated by the California Water Boards. This includes submitting a Nitrogen Budget. You can search "Irrigated Lands Program" for more information and the CA Water Boards website. More information can be found on the California Waterboards ILP Frequently Asked Questions. An organization that helps farmers with their nitrogen budget is the Coalition for Urban Rural Environmental Stewardship. Because the Irrigated Lands Program is regulated by the California Water boards, the local managing agency varies across the state and the lines are drawn by water coalition and not by county. If you do not know who to call, start by calling the resource in your county. Yolo County: Yolo County Farm Bureau Solano County: Solano/Dixon RCD Water Quality Coaltion Sacramento County: Amador RCD

|

Livestock

For more information, contact: California Department of Food and Agriculture Animal Health and Food Safety Services: Meat, Poultry and Egg Safety Branch - 1220 N Street, Sacramento, California 95814 - Telephone: (916) 900-5004 - cdfa.mpes_feedback@cdfa.ca.gov |

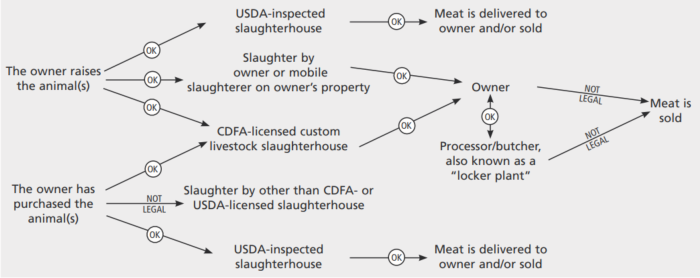

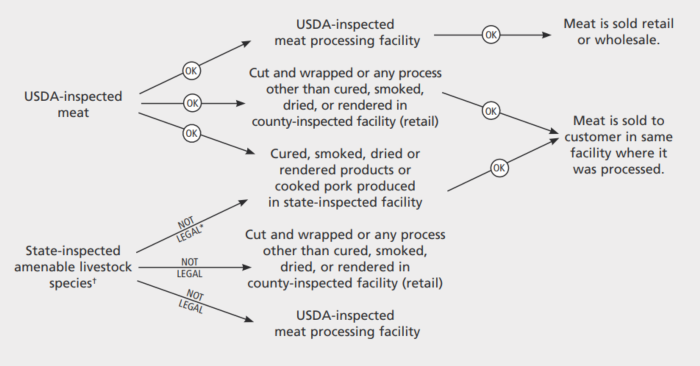

| SLAUGHTER/HARVEST |

|

Anytime meat or a meat product is intended to be sold, the animal must be slaughtered in a USDA-inspected facility. Meat from livestock slaughtered in a CDFA-inspected facility or a non-inspected location, such as a ranch, cannot be sold and must be labeled "Not For Sale" when packaged. |

| PROCESSING/CUT & WRAP |

|

Meat intended to be sold must be processed in a USDA-inspected processing facility. One exception is that a CDFA-inspected facility can process a USDA-inspected carcass and then sell (retail only) the meat only from the same facility. Outside of this exception, all meat processed in CDFA-inspected facilities must be labeled "Not For Sale." More detailed information on legal routes for livestock slaughter and processing, and a specific exception for poultry, can be found in the UC ANR publication Selling Meat and Meat Products |

Pesticides

You are required to have a private applicators certificate for applying pesticides and to file a pesticide report with the state even if you plan to use only organic pesticides.

Yolo County: Regulatory information for Yolo County can be found on the Yolo County Permit and Licensing Information page.

Sacramento County: Regulatory information fro Sacramento County can be found on the Agricultural Commissioner/Sealer of Weights and Measurements Pesticide Enforcement page. You must contact the Ag Commission Office to make an appointment:

Solano County: Regulatory information for Solano County can be found on the Solano County Pesticide Information page.

For all other counties, you can search HERE |

PERMIT/LICENSE TYPES |

The following information on permits/license types is from the Yolo County Ag Commissioner's Office Permit and Licensing Information.Pesticide permits/licenses include:

|

PESTICIDE USE REPORTS |

|

CDFA requires that farmers filed a pesticide use report that documents each instance of pesticide application, including organic pesticides. You will need to register with the Department of Pesticide Regulation, and then file your use reports online at regular intervals. For more information, visit the California Department of Pesticide Regulation: Pesticide Use Reports page. |

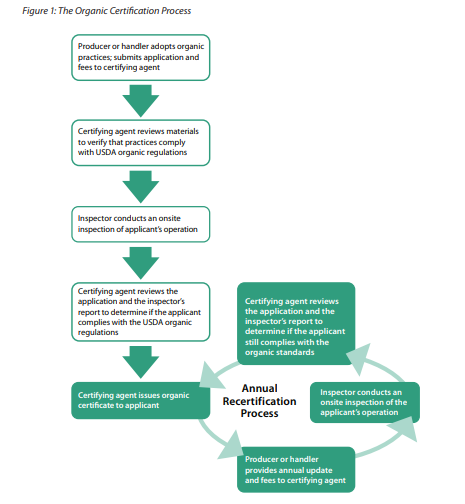

Organic Certification

To become certified organic in California, you must:

1)Register with the CDFA:

2) Become certified through an organic certifying agent:

3) For all other counties:

- Select a Certifying Agency: Choose a USDA-accredited certifying agency to work with. Certifying agencies are responsible for reviewing applications, conducting inspections, and issuing organic certification. In California, one of the widely recognized certifying agencies is the California Certified Organic Farmers (CCOF).

When certified though CCOF or YCOA, producers can use the USDA and/or CDFA certified organic label.

-

Transitional Period: For land with a history of non-organic pesticide use, a transitional period of three years is typically required to achieve organic status. During this period, organic farming practices must be followed, but the crops cannot be labeled or sold as certified organic. However, if the land has not been farmed or pesticides have not been registered with the Agricultural Commissioner's office, organic status can be achieved immediately upon successful completion of the application and inspection process. Call the agricultural commissioner's office to determine the pesticide use history of your property

-

Exemptions for Small-Scale Producers: Farmers with gross sales of less than $5,000 annually may be exempt from organic certification. However, even if exempt, they still need to comply with organic practices. They cannot use the USDA organic logo or the term "certified organic" but can state that they follow organic practices. (Source: USDA National Organic Program: Exempt Producers)

-

Organic Systems Plan (OSP): Organic certification requires the completion of an Organic Systems Plan (OSP), which outlines various aspects of the farm's operations, including inputs, field maps, crop plans, materials lists, soil management plans, pest management plans, harvest and post-harvest procedures, transportation plans, and record-keeping systems. The OSP needs to be submitted to the certifying agency for review.

-

Traceability and Labeling: Organic systems have traceability and labeling requirements to ensure the integrity of organic products. Proper labeling and documentation are necessary to maintain compliance with organic regulations.Visit the CCOF : Develop Compliant Organic Labels page for more information

For the most accurate and up-to-date information on organic certification in California, it is recommended to contact the California Certified Organic Farmers (CCOF) or another certifying agency authorized by the National Organic Program (NOP). They can provide detailed guidance specific to your situation and help you navigate the certification process successfully.

Labeling and Packing

-

Packaging and Labeling Requirements: When selling crops in packed boxes, labels are generally required. The specific requirements for labeling depend on where you choose to sell and the certifications you hold, such as cottage foods or organic. Grading and packing standards need to be followed.

-

Wholesale Packing Standards: Wholesale packing involves considerations such as the size, color, and appearance of the crop, as well as the weight, count, and type of carton or box used. Prices are determined based on these standards, so it's important to include this information in your availability list. If you pack by weight, ensure that your scale is properly calibrated. Consult your buyer for their specific packing expectations.

-

Vegetable Pack Requirements: Detailed instructions on vegetable pack requirements can be found in the resource "Wholesale Success: A Farmer's Guide to Food Safety, Selling, Postharvest Handling, and Packing Produce." This guide provides valuable information on how to meet industry standards for packaging vegetables.

-

Organic Certification Labeling: If you are certified organic, additional labeling requirements specific to organic certification must be followed. Refer to the section on "Organic Certification" to ensure compliance with organic labeling regulations.

It's important to consult the official resources provided by the California Department of Food and Agriculture (CDFA) and relevant certifying agencies for the most up-to-date information and specific guidelines tailored to your farming operations in California.

Poultry

- Regulations for Raising and Selling Poultry: Farmers in California need to comply with federal, state, county, and local laws when raising and selling poultry. Small-scale producers often have exceptions or exemptions. While the state may provide exemptions to federal laws, counties and local jurisdictions have the authority to decide whether to allow those exemptions, particularly regarding slaughter. It is essential for poultry producers to check and understand regulations at all levels of government that apply to their operations.

- Small-scale production for layers generally refers to a flock size of under 3,000 hens. This means that if a producer has fewer than 3,000 laying hens, they would typically fall under the category of a small-scale layer operation.

- Similarly, for meat birds, small-scale production typically refers to processing less than 20,000 birds per year. If a producer processes fewer than 20,000 meat birds annually, they would typically be considered a small-scale meat bird operation.

- These thresholds are commonly used in the industry to define small-scale operations and may qualify for exceptions or exemptions from certain regulations. However, it's important to note that specific exemptions and regulations may vary depending on the jurisdiction and the type of operation.

- CDFA Egg Safety and Quality Management Program: The CDFA Egg Safety and Quality Management Program provides information regarding the raising of laying hens and the sale and marketing of eggs. All individuals selling eggs, even if it's just one egg, in the state of California are required to register as egg handlers. CDFA conducts inspections at farmers markets to ensure producers are compliant with regulations.

-

CDFA Meat, Poultry, and Egg Safety Branch: The CDFA Meat, Poultry, and Egg Safety Branch offers regulatory information specific to meat birds, including slaughter and selling requirements. Farmers can find relevant applications and forms on the CDFA Meat, Poultry, and Egg Safety Branch website. If a USDA-inspected facility is not used for slaughter, there are restrictions on where poultry can be sold. Some counties accept state exemptions from federal regulations, while others do not. It's important to stay informed about new bills and legislation that may affect poultry production and sales.

-

Liability Insurance and Labeling Requirements: It is recommended that farmers involved in chicken processing obtain secondary liability insurance coverage of $1 million. This insurance helps protect against potential liabilities associated with poultry processing operations. Additionally, there are labeling requirements that must be followed, and Shell Egg Food Safety regulations apply to the sale of eggs.

For further questions or assistance, farmers can contact Morgan Doran, UCCE Livestock Advisor for Yolo, Solano, and Sacramento Counties. Morgan Doran can be reached at (530) 666-8738 or mpdoran@ucanr.edu.

SNAP/EBT

The Supplemental Nutrition Assistance Program (SNAP) is a federal food assistance program aimed at supporting individuals and families in need. In California, SNAP is known as CalFresh, and eligible recipients receive benefits through Electronic Benefit Transfer (EBT) cards. If you are a farmer and would like to accept EBT as a form of payment for your products, there are a few options available to you.

-

EBT Machine: To directly process EBT transactions, you can obtain an EBT machine. In California, farmers may be eligible to receive a free EBT machine through the California Department of Social Services (CA DSS). For more information and to inquire about eligibility, you can visit the California EBT Project page. Additionally, you can contact Dianne Padilla-Bates at dianne.padilla-bates@dss.ca.gov or reach out to the Community Alliance with Family Farmers (CAFF) at (831) 761-8507.

-

Farmers Markets: Many farmers markets facilitate EBT sales by selling vouchers or tokens to EBT customers. This allows you to accept EBT payments at farmers markets without needing your own EBT machine. Participating in farmers markets can expand your customer base and provide access to individuals utilizing CalFresh benefits.

-

Additional Providers: You can explore other EBT machine providers beyond the CA DSS program. The USDA Food and Nutrition Service website (www.fns.usda.gov) provides a list of alternative providers that can assist you in obtaining an EBT machine.

It's important to note that accepting EBT as a form of payment may require some administrative steps and compliance with regulations. Familiarize yourself with the specific rules and guidelines for accepting EBT payments in California, as they can vary based on your location and the type of products you sell.

Remember to stay updated with the latest guidelines and requirements from the California Department of Social Services and other relevant agencies to ensure compliance with EBT regulations and best serve your customers.